SUMMARY:

- Historical retrospective between countries (France vs. UK)

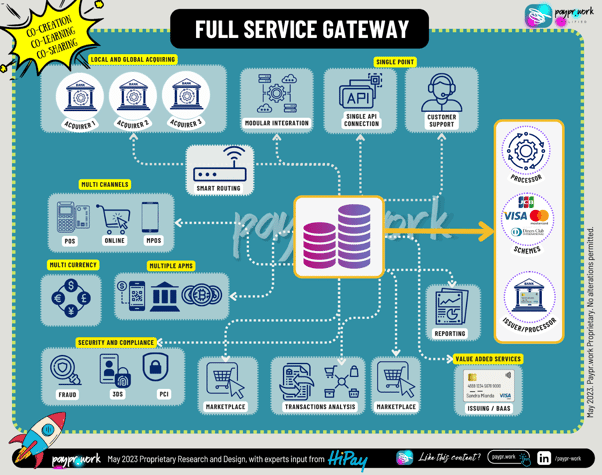

- Description of full service vs. gateway

- Are all full service PSPs the same?

- How HiPay stands out in the market

A full service or gateway PSP: what is the difference?

In a context where e-commerce is increasingly competitive, the payment industry has also developed strongly in recent years in order to better meet the needs of merchants and the expectations of their customers.

Historical retrospective of the 'full service' in France and in the UK

As a reminder, banks have always played a central role in the payment industry in France. Previously, e-merchants used to seek their expertise because of their affiliation with the bank card networks (Visa, Mastercard, etc.). However, the latter relied on third parties to offer them some of their services, such as the display of payment pages. To manage acceptance, they also had to connect to gateways, whose role was mainly technical.

In the UK, in parallel with certain specialized banks with a specific division in charge of payments or platforms such as Worldpay, other PSPs immediately proposed a "full service" model in order to directly manage acceptance and acquisition.

These "all-in-one" offers quickly became established because of their greater added value and the full service model is now recognised as the best in the market. Appreciated by merchants for its many advantages over payment gateways, it allows them to take advantage of business intelligence and to group all technical and financial data within a centralised interface.

This means that you have all the information that is crucial to your business at your fingertips, including chargebacks and fraud prevention. You can also view the entire lifecycle of your transactions, from capture to payout.

You also no longer need to juggle between payment gateways and banks to find your way through order references that don't match. Fullservice PSPs take care of everything, including the relationships between the various players, saving CFOs a lot of time and making their daily work easier.

Furthermore, with the democratisation of the Web in the 2000s, the commerce sector has had to adapt to many changes in consumer purchasing and payment habits. As the market becomes more international, borders are being pushed back, opening the door to a new generation of fullservice providers to accompany this digital revolution.

The trend is also towards unified commerce, which is already well established. Indeed, just as payment gateway providers are gradually refocusing on full service offerings, many fintechs are now focusing on omnichannel. The gap is thus widening between providers who limit themselves to collection and those who manage in-store acceptance.

As a result of these new challenges, banks are losing ground in this sector. As the customer experience has become a key criterion for boosting sales, full service is indeed much more advantageous. Just like online shops, physical shops are therefore moving away from banks and increasingly turning to full service.

What is a full service PSP?

What is a full service offer from a Payment Service Provider (or PSP)?

infography by Paypr.work

Are all PSP full service systems the same?

However, not all full service payment service providers are equal. It is therefore important to compare the offers carefully in order to choose the one that really suits your needs.

There are several criteria to consider, including:

- The choice of solutions adapted to the project model (unified commerce, cross-channel reimbursement, marketplace, etc.);

- The diversity of payment methods and means offered to facilitate purchasing (payment in installments, subscriptions, etc.) and international expansion to stand out from the competition;

- Ease of integration (hosted fields, hosted page, iFrame) with the existing ecosystem;

- Constant addition of innovative features and robustness of the platform;

- Performance optimisation for a better conversion rate;

- Expert support for personalised support (including configuration of the anti-fraud module).

HiPay's added value

At HiPay, our next generation full service solution meets all these requirements and more.

With HiPay Sentinel, you get a fast and powerful anti-fraud module to help your business grow with peace of mind.

Support is also one of our strengths! Our teams of experts provide you with an in-depth analysis of your needs and regular monitoring of your key performance indicators to take your payment strategy to the next level, both online and in-store.

In addition, our solutions adapt to the ever-changing expectations of your customers to facilitate your international development with a wide variety of payment methods and means.

We are always ready to listen and will be delighted to answer your questions and support you in your project.

Do not hesitate to contact us to find out more about our all-in-one offer!