Consumer habits seem to have shifted permanently towards the Internet. Admittedly, growth in e-commerce has slowed slightly, after years of strong growth accentuated by the particular context of the health crisis and successive lock-ins. But the advent of new technologies and ever-higher expectations in terms of customer experience promise a bright future for online purchases, driven in particular by the use of smartphones. As a result, the need for a smooth shopping experience is becoming ever more important, and the conversion rate is more than ever at the heart of the challenge.

At the same time, fraud and cyber-threats are becoming more and more sophisticated as e-commerce expands, calling on players to take greater precautions. Added to this need for security is the tightening of regulations in recent years, whether it be the entry into force of the second European Payment Services Directive (PSD2), designed to make online payments more secure, or the RGPD, aimed at better protecting personal data.

Striking the right balance between increased security requirements on the one hand and the need to preserve the customer experience as far as possible on the other is a complex task. In fact, the payment process is where these challenges lie. "Payment is a real pillar of e-commerce. It comes at the end of the entire value chain set up by e-tailers, and in a way validates all the work they have done," says François Ribot, Business Development Manager at HiPay.

A high-performance payment process must, of course, meet the technical specifications of the market and the standards in force. But above all, it is about providing the simplest, most fluid solution possible, without neglecting security. "It is estimated that the range of losses for merchants is between 5% and 15%. At a 15% error rate, performance is unsatisfactory and there is a lot of room for improvement, whereas at 5%, we are approaching an acceptable threshold," he adds. Offering the right payment scenario for the right customer is therefore the challenge that the payment service provider must be able to meet for the merchant.

Fewer steps for the user, without skimping on safety

There's no need to choose between the fluidity and speed of the digital customer experience and enhanced security guarantees. The frictionless payment experience is the ideal solution, capable of satisfying all requirements. To achieve this, it is necessary to determine whether or not it is necessary to use the 3-D Secure functionality, and to make the steps relating to the user experience as light as possible, by making it easy to enter and save the bank card number, for example.

"Before PSD2 came into force, it was up to the merchant to decide whether or not to activate 3-D Secure. Today, it is up to the cardholder's bank to make this decision. The PSP (Payment Service Provider) must then provide the bank with tangible information to justify any exemption from strong authentication, in particular following a risk analysis of the transaction for a frictionless payment. Its role and expertise are therefore crucial.

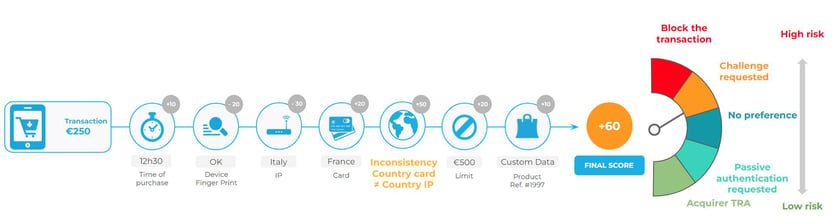

HiPay was already involved in this type of approach before DSP2. We propose a scoring model based on a certain number of criteria, adapted to each merchant and for which we define a fraud profile so that we can then implement a management policy that takes account of each case, on the basis of the information collected", explains François Ribot. Depending on the transaction and its characteristics, 3-D Secure may or may not be activated.

With HiPay Sentinel, our anti-fraud tool, more than 80 criteria are taken into account when calculating the score. Each criterion is given a score. By combining all the criteria, we obtain an overall reference score, which can be translated into action in real time. The data collected covers both customer knowledge and the technological context.

"Each merchant knows its fraud typology and its customer base. We naturally take these criteria into account, bearing in mind that they are constantly evolving. It's important to take into account other parameters such as the volume of purchases or the frequency with which they are made, for example. This approach gives us a very detailed analysis so that we can make the best decision", he continues. The more we feed this scoring system with various data, the more we can guarantee security, with as little impact as possible on conversion rates.

Thanks to the support of our experts and our flexible, customisable anti-fraud module, we make our merchants' transactions more fluid and secure, maximising their success rate while protecting them from fraud attempts.

Want to find out more about our anti-fraud tool? Contact us now!