As an (e-)merchant, it’s crucial to have access to accurate information to fully understand your payment data.

To better help you optimize your performance, we have recently enhanced HiPay Console, our powerful management interface, to provide you with a more detailed view of your transactions.

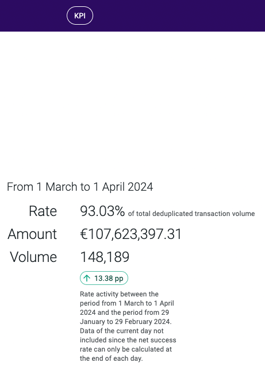

The net success rate, a much-awaited indicator for merchants, has been added to complement the traditional gross success rate.

Let’s take a closer look at the net success rate

For a more detailed analysis of your transactions, the net success rate gives you visibility of transactions that have been authorized, i.e., those for which customers have successfully completed the payment process.

In concrete terms, the net success rate is calculated as follows:

Net success rate = number of authorized transactions / number of deduplicated created transactions* over the period chosen by the merchant, by email and by amount.

*If a user fails to authorize a transaction several times, the transaction refusal is only counted once, ensuring a fair and accurate calculation.

This is the fundamental difference with the gross success rate, which does not take into account the deduplication of transactions (i.e., the deletion of duplicate data).

Please note: You cannot have the net success rate for the same day, as the net success rate is only calculated at the end of each day.

Example of calculation between gross and net success rate

Let’s imagine that over the course of a week, you have:

- 2,000 authorized transactions,

- 2,140 deduplicated created transactions,

- 2,300 created transactions in total,

- 160 transactions are authorization attempts.

Your gross success rate will then be: (2,000 / 2,300) x 100 = 86.95%

Whereas your net success rate will be: (2,000 / 2,140) x 100 = 93.45%

Key benefits of the net success rate

- Greater accuracy: By focusing exclusively on deduplicated transactions, the net success rate offers a more reliable view of payment process performance.

- In-depth data: In addition to the success percentage, the widget displays in enlarged view the total amount and volume of successful transactions, providing you with detailed information for further analysis.

- Evolution badge: The badge at the bottom of the widget shows the evolution of the rate in percentage points (pp) compared to the previous period, allowing you to see its evolution over time instantly.

Both rates are available in HiPay Console

If you already have the gross success rate on your dashboard, it will be directly replaced by the net success rate.

However, don’t worry: the gross success rate will remain available in the widget catalog of our management interface.

As these indicators are complementary, you’ll be able to add them both to your dashboard to get an even more detailed overview and understand the issues encountered or the solutions to be applied (such as improving the UX or adding payment methods, for example).

To conclude, as Estelle Primeau, our HiPay Console expert, sums up: “the net success rate aims to enable a more precise and in-depth analysis of your transactions. We are convinced that this new widget in HiPay Console will contribute to a more comprehensive monitoring of your performance.”

Because our management interface is the tool you need to explore the full power of your data and analyze your business in fine detail.

Ready to find out more about HiPay Console?

Check our website for a detailed presentation of its many features, designed to simplify the management of your payment data.